March 5, 2025

Understanding the Impact of Critical Changes in Tariffs, Taxes and R&D Rules

By Rono Ghosh, Partner, International Tax at BPM; Andre Shevchuck, Bay Area Region Managing Partner, Specialty Tax Services Leader, BPM; and Sarah Weaver, CPA, Corporate Tax Partner, BPM

Recent legislative changes and policy shifts are creating significant challenges for the biotech industry, affecting everything from supply chains to tax obligations. As companies navigate this complex landscape, understanding the key impacts and potential mitigation strategies becomes crucial for business planning and sustainability. The biotech sector, already operating in a complex regulatory environment, now faces additional hurdles that affect early-stage research organizations through established pharmaceutical companies.

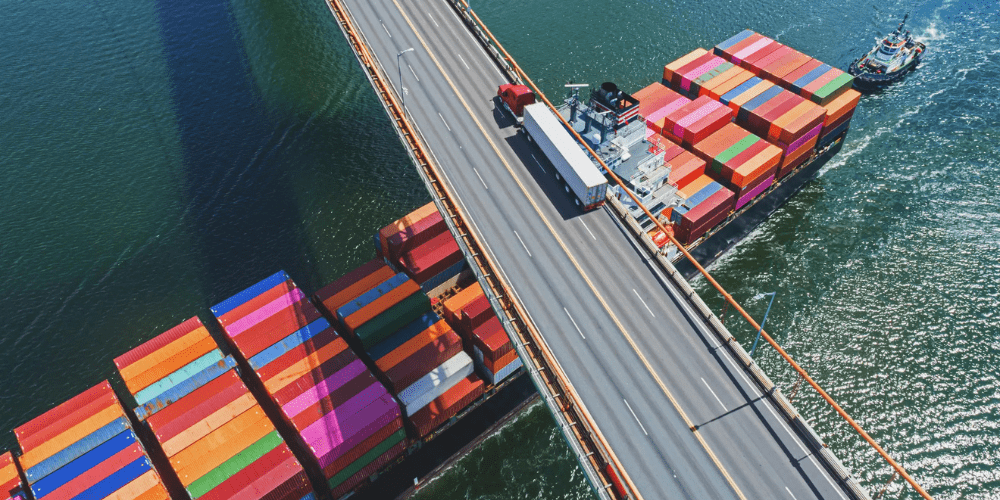

Tariff Impact on International Trade

The implementation of new tariffs on goods from Canada (25%), Mexico (25%) and China (10%) is poised to significantly impact biotech companies’ operations and costs. Note that the application of the tariffs on Canada and Mexico has recently been delayed until March 4. While earlier-stage companies going through trials may feel less immediate volume-based impact, their tighter cash flows make them particularly vulnerable to price increases. These tariffs represent a substantial shift in international trade policy that directly affects the industry’s global supply chains.rn

The effects are two-fold. First, many biotech companies rely on components and products sourced from these countries, particularly China, where historically lower costs have made it an attractive supplier for pharmaceutical production components.

Second, retaliatory tariffs from these nations will affect U.S. companies’ export capabilities, even those sourcing domestically. This reciprocal action creates a complex web of trade barriers that biotech companies must navigate.

Larger, more established biotech companies have been preparing for these changes by diversifying their supply chains and revising contracts. Some have already begun moving contracts away from Chinese contract manufacturing organizations (CMOs) and adjusting their insurance language and providers. However, smaller and earlier-stage companies often lack the resources to implement such preventive measures, making them more susceptible to these trade pressures. Industry experts predict these changes will likely result in broader inflation across pharmaceutical and biotechnology products.

The impact extends beyond direct manufacturing costs. Companies must now consider restructuring their global operations, reevaluating strategic partnerships and potentially relocating certain operations to minimize tariff exposure. This reorganization requires significant investment in supply chain infrastructure and relationship building with new suppliers, creating additional financial pressure on an industry already characterized by high development costs.

Corporate Income Tax Compliance

The corporate tax landscape is undergoing significant changes under the current administration. While there are proposals to reduce corporate tax rates, particularly for companies manufacturing in the U.S., these changes come with increased complexity in compliance requirements and reporting. The administration has indicated a preference for companies that manufacture domestically, potentially offering more favorable deductions and accelerated depreciation calculations.

Tax professionals note that international tax compliance has become substantially more complex in recent years, with forms like the Form 5471 growing significantly in length and complexity. This increased reporting burden has led to higher compliance costs and more complicated tax provision work for biotech companies.

Additionally, the administration has proposed penalties—sometimes referred to as “tariffs” but actually functioning as penalty taxes—on U.S. companies offshoring certain activities. This could particularly affect biotech companies that conduct R&D overseas to take advantage of foreign tax credits or cost efficiencies, with potential additional taxes of 5-10 percent on top of the standard corporate rate. These penalties specifically target companies performing activities outside the U.S., creating additional considerations for biotech firms with global operations.

Section 174 and R&D Expense Capitalization

Perhaps the most significant tax change affecting the biotech industry is the Section 174 requirement to capitalize R&D expenses, which became effective in 2022. Despite widespread expectation of a legislative fix and bipartisan support for changes, the requirement remains in place, with potential modifications not expected until 2026. This provision has created challenges for research-intensive companies in the biotech sector.

Under these rules, companies must capitalize and amortize R&D expenses over five years for domestic spending and fifteen years for foreign spending, rather than deducting them immediately. This creates a particularly challenging situation for biotech startups, where R&D typically constitutes the majority of operating expenses. The impact is especially severe for pre-revenue companies that rely on federal grants for R&D funding, as they may face tax liabilities without revenue streams to cover them.

The impact has been substantial: companies showing losses on their financial statements may still face tax obligations due to the timing difference between financial and tax accounting for R&D expenses. This situation is especially pronounced when companies receive collaboration deals, as revenue recognition for tax purposes is typically more accelerated than for financial reporting. Many startup companies have been surprised to find themselves in taxable positions despite considering themselves pre-revenue organizations.

Recent discussions suggest that any potential future fixes might only address domestic R&D spending, leaving the 15-year amortization requirement in place for foreign R&D activities. This would continue to affect many startups that rely on offshore third parties for clinical trials and other research activities.

Key Considerations for Biotech Companies

1. Supply chain planning: Companies should evaluate their supply chains and consider diversifying sources to mitigate tariff impacts, while weighing the costs and benefits of domestic versus international suppliers. This includes assessing alternative suppliers, considering geographical diversification and potentially restructuring existing supplier relationships to optimize costs and minimize tariff exposure.

2. Tax planning: Early involvement of tax advisors in collaboration agreements and business development deals can help structure revenue recognition more favorably for tax purposes. Companies should particularly focus on documentation and analysis to ensure accurate Section 174 calculations and avoid overstating capitalized amounts.

3. R&D strategy: Companies should carefully evaluate the location and structure of their R&D activities, considering the differential treatment of domestic versus foreign research expenses. This may involve reassessing the balance between internal and external research activities and the geographical distribution of research operations.

4. Compliance preparation: Organizations need to prepare for increased complexity in tax reporting and potentially higher compliance costs. This includes developing robust systems for tracking and documenting R&D expenses, maintaining detailed records of international transactions, and ensuring adequate resources for enhanced reporting requirements.

5. Strategic planning: Companies should consider these tax and tariff implications early in their business planning processes, particularly when structuring collaborative agreements, planning research activities or expanding operations internationally.

While tax considerations shouldn’t be the primary driver of business decisions, they have become increasingly important in strategic planning. Companies that proactively address these challenges while maintaining focus on their core mission of innovation and development will be better positioned for success in this evolving legislative landscape. The key is to balance compliance requirements with operational efficiency while maintaining the flexibility to adapt to further changes in the regulatory environment.